Experience You Can Trust

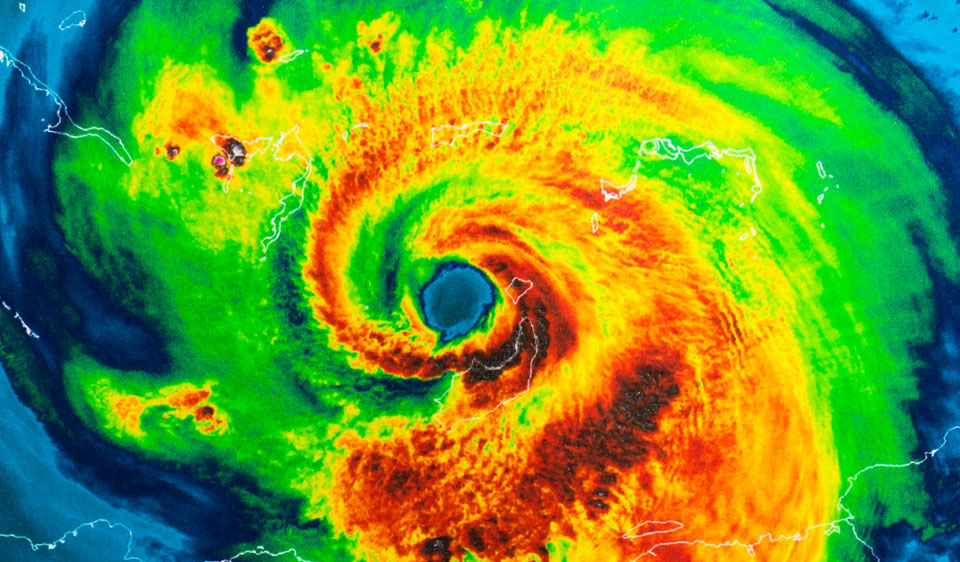

For most, the biggest investment a person will ever make is the purchasing of a house. Depending on the age of the house, there are many different problems that can and will occur. Residential claims include broken pipes, cracked floors, kitchen leaks, fires, hail, mold, hurricane, flood, theft, and vandalism. However, the list is not limited to just these perils mentioned. Our team of professional public adjusters will identify potential problems before they occur as well as explain the process for the damage you may already have.